In today's dynamic business environment, accounting professionals are increasingly moving beyond traditional compliance work to become trusted advisors for their small business clients. This evolution requires a robust technological framework that can seamlessly integrate client management, financial data and analytical capabilities. Enter the powerful combination of Zoho Practice, Zoho Books, and Zoho Analytics – a comprehensive solution that enables accountants and financial advisors to deliver high-value advisory services efficiently and effectively.

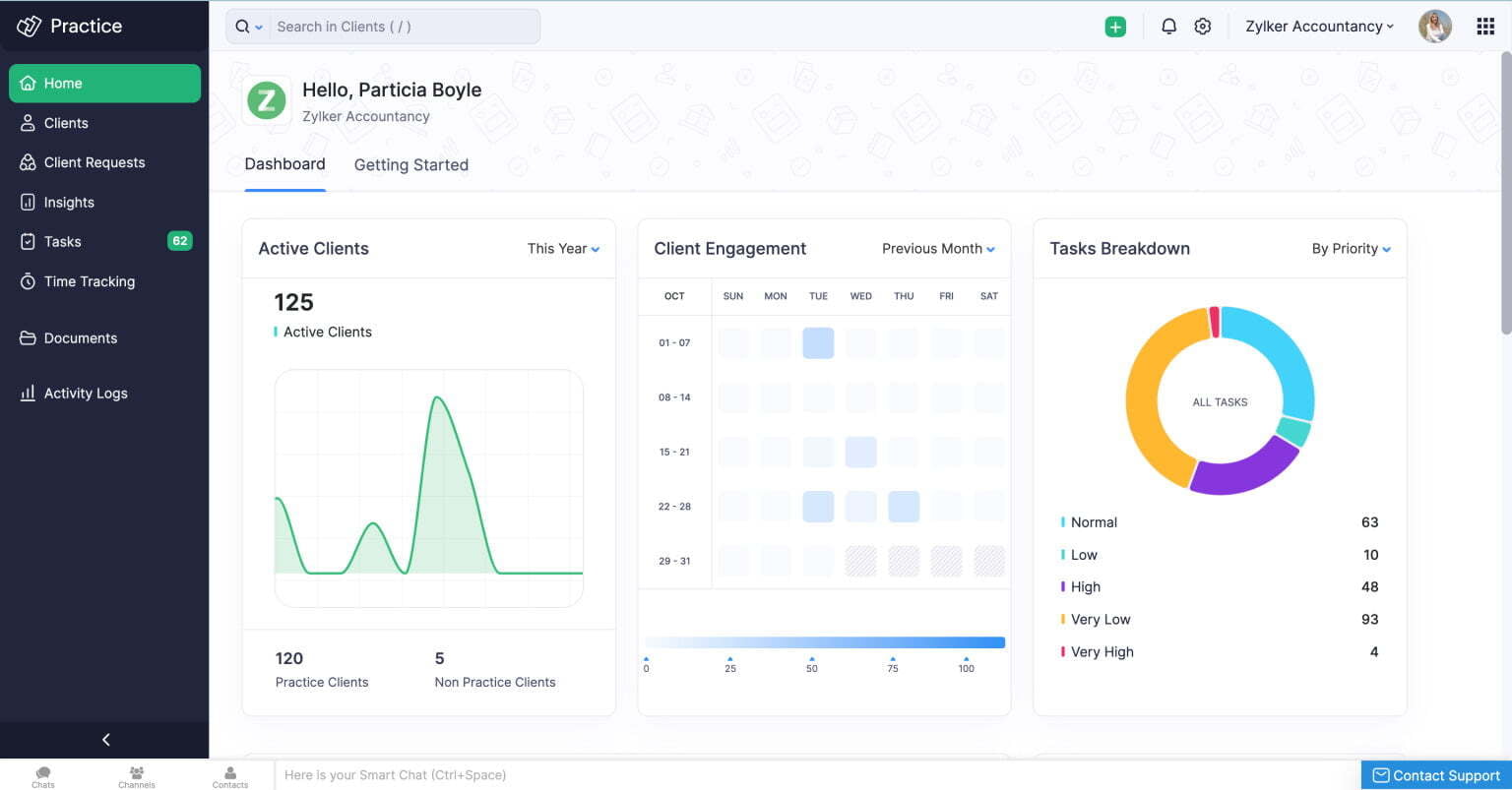

The Foundation: Zoho Practice

Zoho Practice serves as the cornerstone of your advisory framework, offering:

- Centralized client management

- Streamlined workflow automation

- Secure document sharing and collaboration

- Integrated time tracking and billing

- Client portal for seamless communication

This platform ensures that your practice operations run smoothly, allowing you to focus on delivering value-added services to your clients.

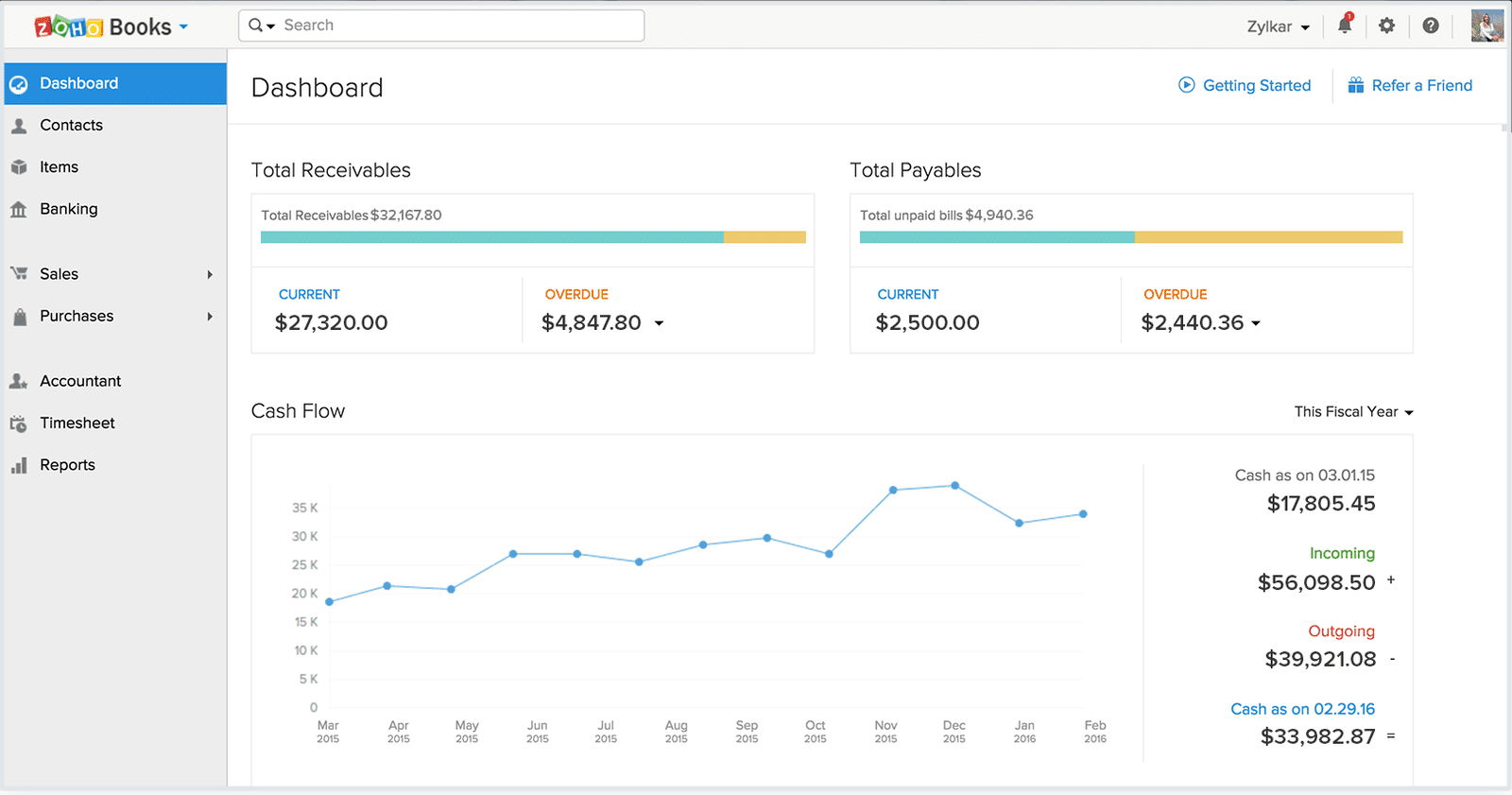

Financial Management: Zoho Books

At the heart of any advisory service lies accurate financial data. Zoho Books provides:

- Real-time financial tracking

- Automated bank feeds and reconciliation

- Customizable reporting

- Invoice and expense management

- Multi-currency support

- Tax compliance tools

The integration with Zoho Practice ensures that client financial data flows seamlessly into your advisory workflow.

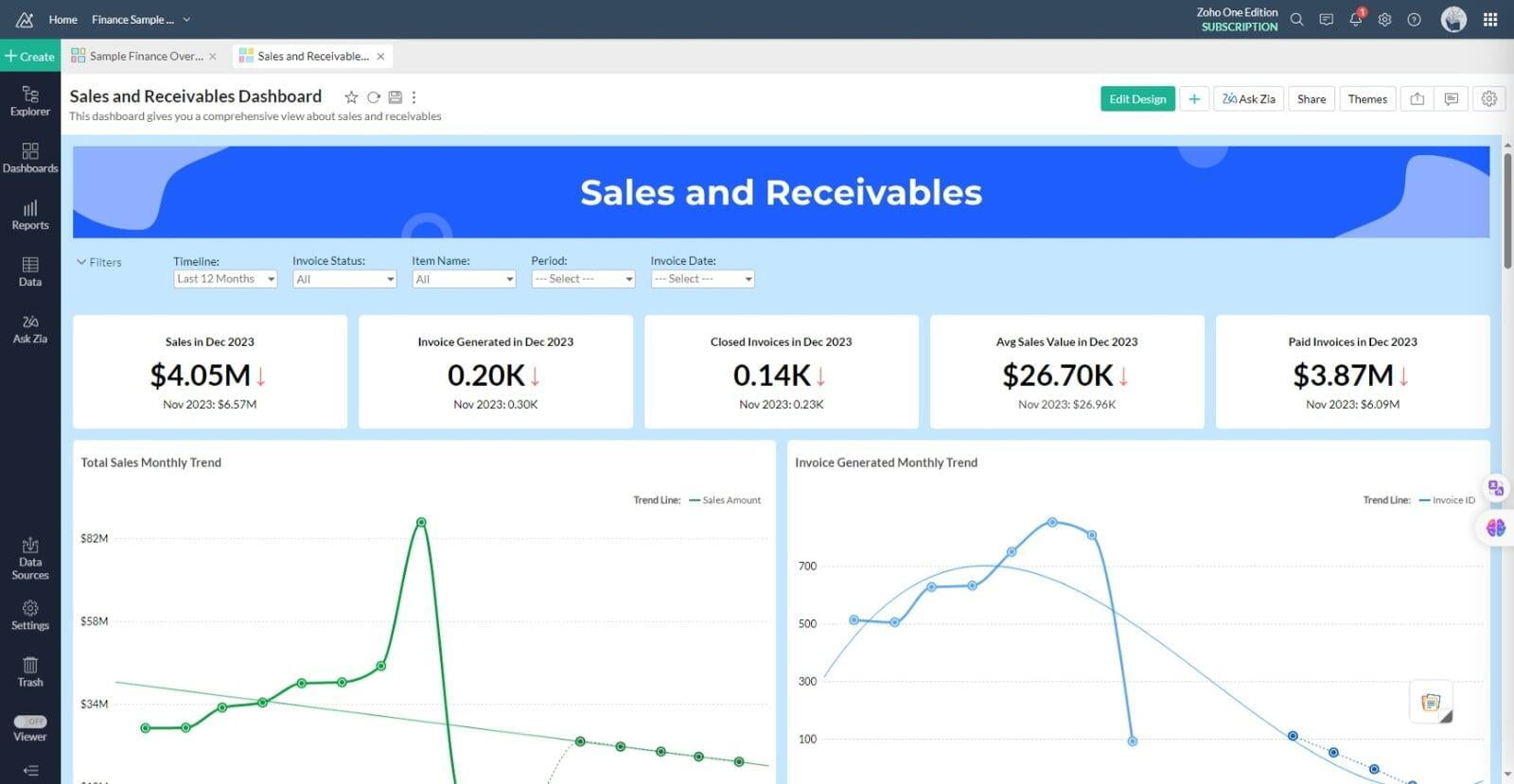

Data-Driven Insights: Zoho Analytics

Transform raw financial data into actionable insights with Zoho Analytics:

- Custom dashboard creation

- Advanced data visualization

- Predictive analytics capabilities

- Automated reporting

- Cross-platform data integration

- Business intelligence tools

Creating a Comprehensive Advisory Framework

1. Initial Setup and Integration

- Configure Zoho Practice for your firm's specific needs

- Set up client profiles and service packages

- Integrate Zoho Books with client accounting systems

- Establish data flows between platforms

- Create standardized reporting templates

2. Developing Advisory Workflows

- Design service delivery processes

- Create automated triggers for regular check-ins

- Establish KPI monitoring systems

- Implement early warning indicators

- Set up regular reporting schedules

3. Delivering Value-Added Services

With this integrated framework, you can offer:

- Cash flow forecasting and management

- Business performance analysis

- Strategic planning support

- Budgeting and forecasting

- Risk assessment and management

- Growth opportunity identification

Best Practices for Implementation

1. Start Small

- Begin with a pilot group of clients

- Test and refine your processes

- Document successful approaches

2. Standardize Your Approach

- Create service templates

- Develop standardized reporting packages

- Establish clear communication protocols

3. Focus on Client Education

- Train clients on portal usage

- Provide regular insights and updates

- Schedule periodic review meetings

4. Continuous Improvement

- Gather client feedback

- Monitor service efficiency

- Update processes based on learnings

Measuring Success

Track the effectiveness of your advisory framework through:

- Client satisfaction metrics

- Revenue per client

- Advisory service adoption rates

- Time savings through automation

- Client retention rates

- Referral rates

Conclusion

Building a comprehensive financial advisory framework using Zoho's integrated solutions enables accounting professionals to transform their practice from compliance-focused to advisory-led. By leveraging the combined power of Zoho Practice, Books, and Analytics, firms can deliver sophisticated, data-driven advisory services while maintaining operational efficiency.

The key to success lies in thoughtful implementation, standardization of processes, and a commitment to continuous improvement. As your clients' businesses grow and evolve, this integrated framework provides the scalability and flexibility needed to adapt your advisory services accordingly.

Next Steps

1. Assess your current technology stack

2. Identify gaps in your advisory services

3. Plan your implementation timeline

4. Select pilot clients for initial rollout

5. Begin the transformation of your practice

Remember, the journey to becoming a trusted advisor is ongoing. With the right tools and framework in place, you're well-positioned to deliver significant value to your small business clients while building a more sustainable and profitable practice.

---

Want to learn more about implementing this framework in your practice? Contact us for a detailed consultation on getting started with Zoho's integrated solutions.